Taxes

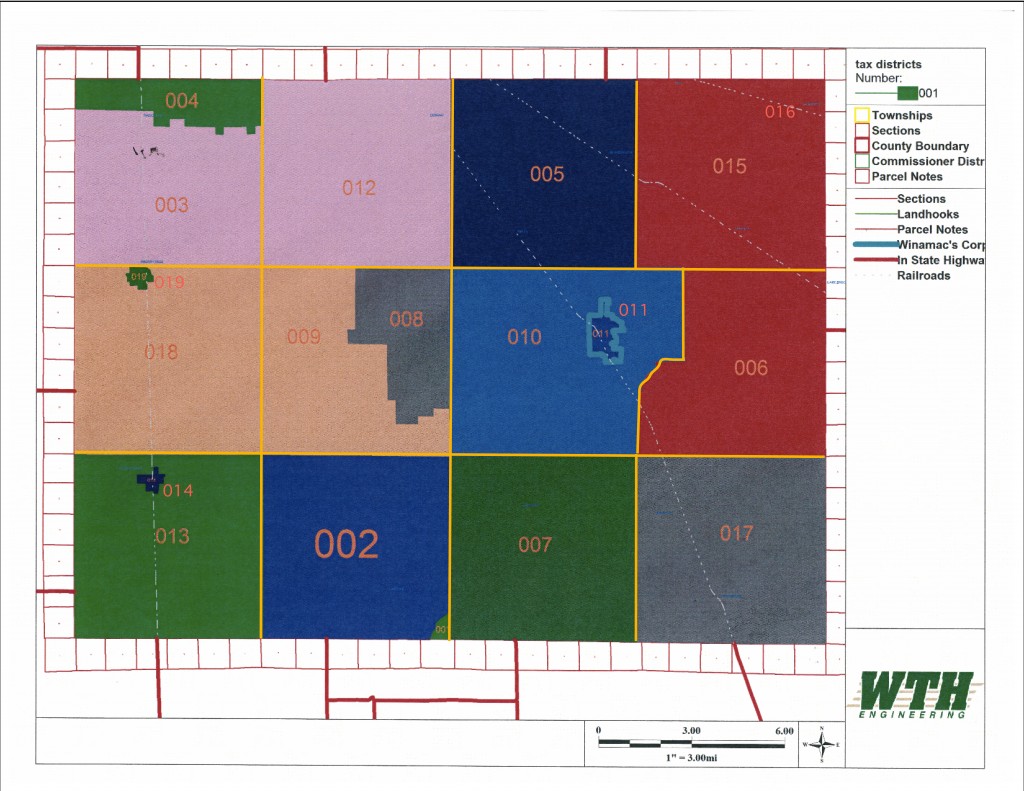

You already know that Indiana has some of the business-friendliest income taxes around, but did you know that, in Pulaski County, we strive to keep our property-tax rates low to make it easier to invest in your company’s employees, equipment, and facilities, and not in government? In fact, all 15 of our unincorporated taxing districts have rates in the bottom quartile of all taxing districts in Indiana, and most land available for industrial development lies outside of municipal boundaries!

| District | Tax Rate | District | Tax Rate |

| 002 – Beaver Township I (west/bulk) | 1.0341 | 019 – Town of Medaryville (White Post) | 2.3790 |

| 001 – Beaver Township II (southeast) | 1.1481 | 010 – Monroe Township | 1.2289 |

| 003 – Cass Township (south/bulk) | 1.1249 | 016 – Town of Monterey (Tippecanoe) | 2.1444 |

| 004 -Cass Township, north | 1.4091 | 012 – Rich Grove Township | 1.4062 |

| 014 – Town of Francesville (Salem) | 1.7847 | 013 – Salem Township | 1.1844 |

| 005 – Franklin Township | 1.2213 | 015 – Tippecanoe Township | 1.1493 |

| 006 – Harrison Township | 1.2339* | 017 – Van Buren Township | 1.2864* |

| 007 – Indian Creek Township | 1.2222 | 018 – White Post Township | 1.1620 |

| 008 – Jefferson Township, east | 1.2231 | 011 – Town of Winamac (Monroe) | 1.9719 |

| 009 – Jefferson Township (bulk/west) | 1.1091 |

*Some properties in these townships are subject to additional conservancy-district rates.

Click here to view the tax-rate table breaking down the sub-rates assessed by each taxing unit (county, townships, libraries, schools, and towns).